These are challenging times.

The coronavirus, COVID-19, has quickly traveled around the world. Countries have closed their borders, healthcare services are stretched past their limits, large regions are quarantined, and millions of people are self-isolating at home.

Still, another challenge seems to be on its way: a global economic recession.

The catastrophic effect of the coronavirus is rippling its way through economies, devastating businesses and crippling economic growth.

Simply put, things don’t look good.

But what exactly is a global recession? Will it happen? And if so, what can you do about it to stay safe?

Let’s find out.

What is an Economic Recession?

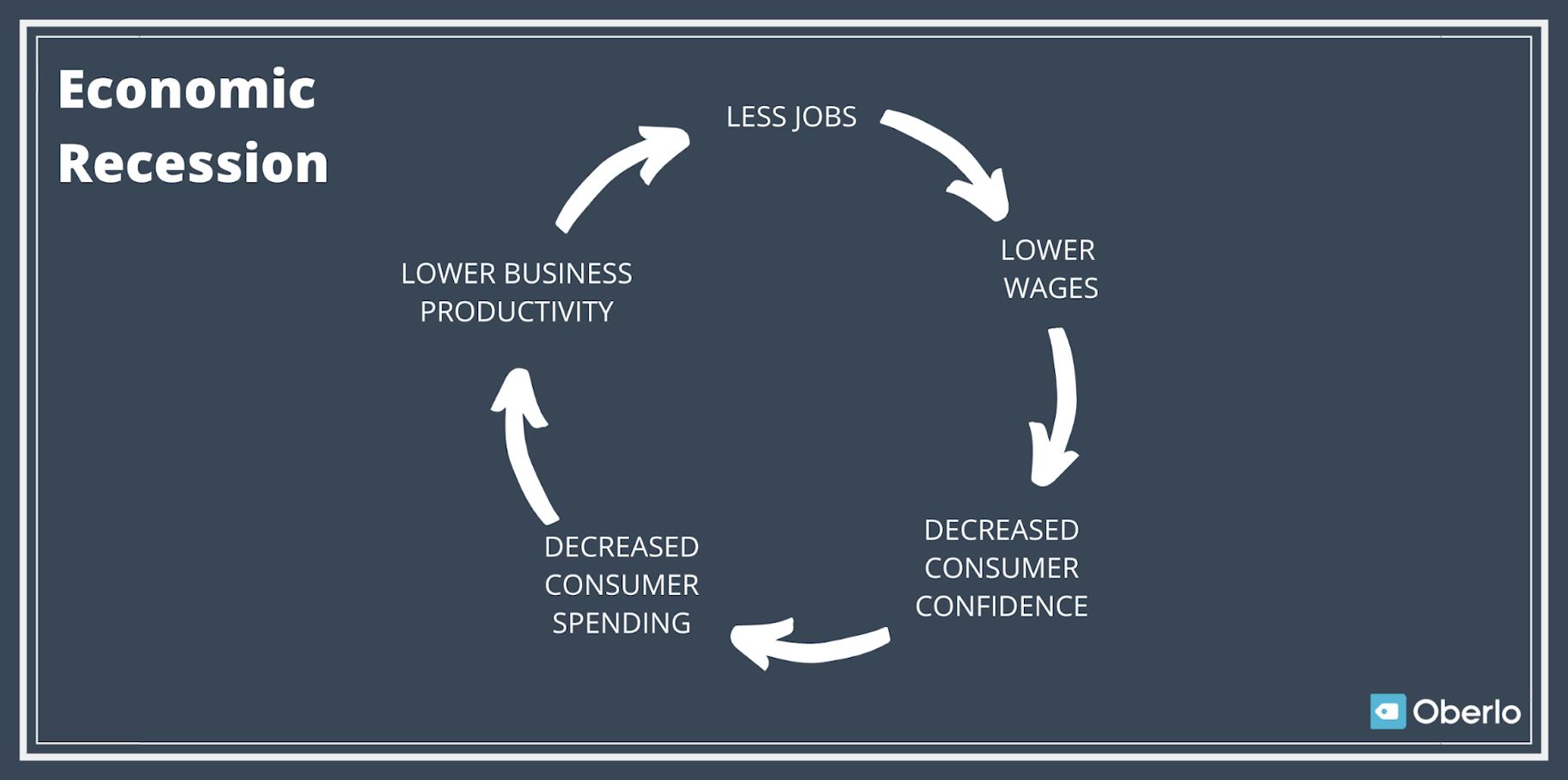

Here’s the most accepted definition of an economic recession:

A period in which the gross domestic product (GDP) – the amount a country produces and sells – declines for two or more consecutive financial quarters.

→ Click Here to Launch Your Online Business with Shopify

In other words, a country’s finances aren’t growing, they’re shrinking.

In the U.S., recessions are measured and confirmed by The National Bureau of Economic Research (NBER). This group of economists has a more detailed definition of an economic recession:

“A recession is a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales. A recession begins just after the economy reaches a peak of activity and ends as the economy reaches its trough.”

But what does this mean exactly?

First, let’s take a look at how economies work when they’re healthy and growing.

Usually, high consumer confidence generates more spending, which in turn leads to higher business productivity. Healthy businesses create more jobs and offer higher wages, which then generate more consumer confidence.

It’s a cycle that benefits everybody.

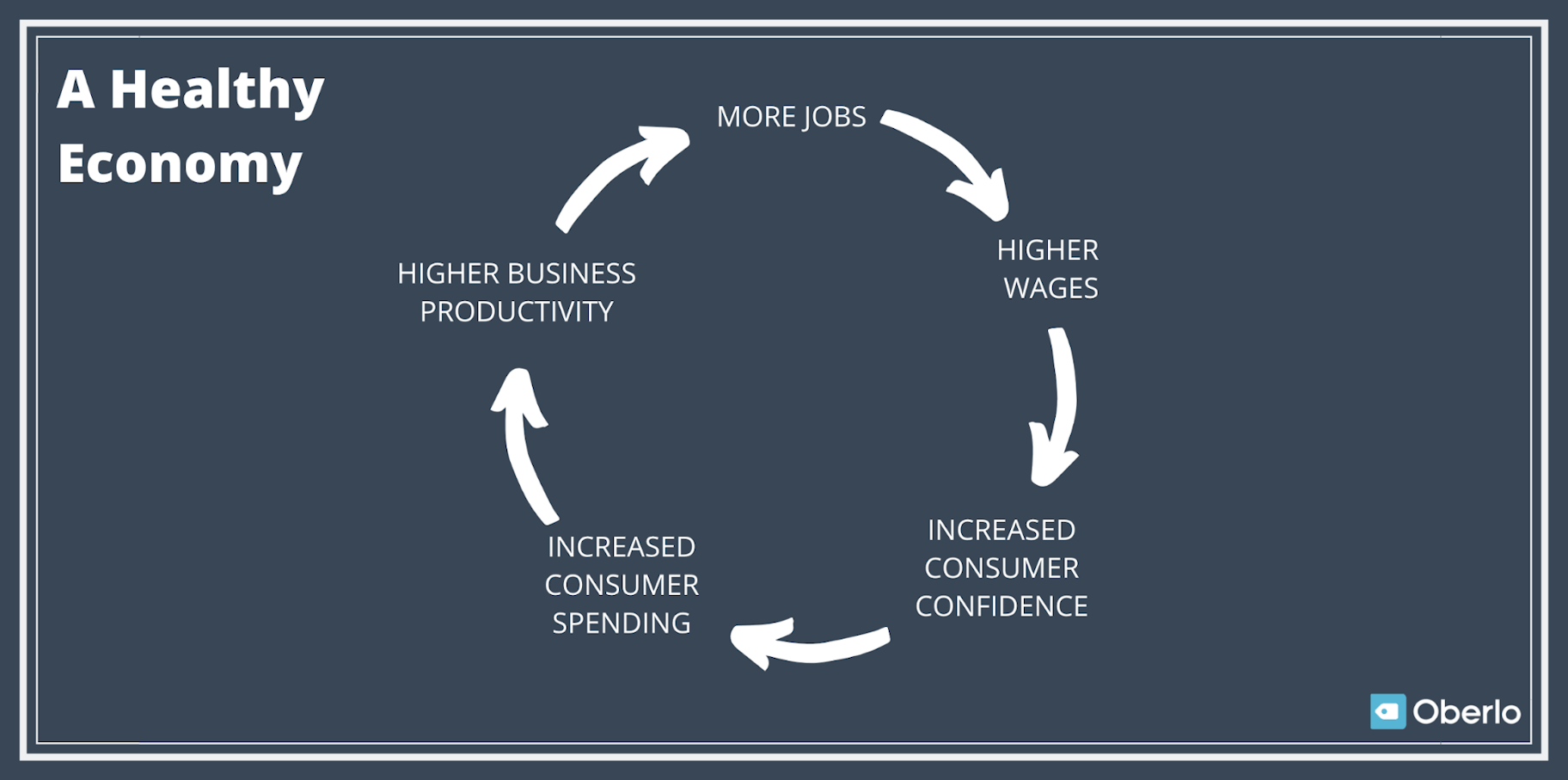

Now, an economic recession is the exact opposite of this cycle.

It usually starts with a loss of business or consumer confidence. When the majority of people or businesses in a country suddenly stop spending as much money as they usually do, a downward spiral kicks into gear.

Let’s look at what happens next:

When consumer spending goes down, businesses adjust their strategies. This means they hire fewer people, lay off staff, and buy fewer supplies from other businesses. The unemployment rate grows and consumer confidence plummets further.

At this point, a vicious cycle is in full swing and things are about to get a whole lot worse.

What Happens During an Economic Recession?

Once a recession starts, it’s difficult to stop. It spirals out of control and the consequences are severe for virtually everyone.

Here are 14 things that can happen during an economic recession:

- Business profits take a hit and many go bankrupt.

- People lose their jobs.

- It becomes difficult to find work and make ends meet.

- In particular, young people entering the job market find it difficult to secure a job.

- Wages go down.

- People reduce their spending, invoking a paradox of thrift. This typically leads to reduction in aggregate demand and, consequently, economic growth .

- Many families have to relocate to avoid high rental costs or to find work. In this situation, children have to change schools and the family loses its social support network.

- Due to financial strain and other factors, families struggle and domestic violence increases.

- People struggle to pay their debts, which damages their credit scores. This makes it more difficult for many to borrow money in the future – which in turn contributes to more economic stagnation.

- People default on their debts and families lose their homes, cars, lands, and other assets.

- The real estate market is flooded with people who can’t afford their mortgages and those who need money. As a result, house prices go down. This is bad news for many people who rely on the equity they built up in their homes to fund their retirement.

- Business investments go down and it becomes harder to start a business.

- Interest rates go down as federal governments attempt to simulate growth.

- Most people have to reign in their lifestyle expenses. This means fewer leisure activities, vacations, dining out, etc.

Bottom line, economic recessions are hard, harsh, and unforgiving. So…

Will There Be an Economic Recession in 2021?

In the U.S., the NBER’s Business Cycle Dating Committee is the only organization that can officially declare when a recession starts and ends.

However, it typically takes months for the group to announce the timeline.

For example, the NBER announced in December 2008 that the Great Recession had begun an entire year earlier in December 2007.

So what should we think in the meantime?

Unfortunately, a global economic recession seems highly likely – we just don’t know how bad it’ll get.

Here’s what the experts say.

“I feel like the 2008 financial crisis was just a dry run for this… This is already shaping up as the deepest dive on record for the global economy for over 100 years. Everything depends on how long it lasts, but if this goes on for a long time, it’s certainly going to be the mother of all financial crises.”

— Kenneth S. Rogoff, Harvard economist.

“This is so unprecedented in its sudden-stop nature. It’s directly impacting industries that are not usually the front line of recessions.”

— Nick Bunker, economic research director at the Indeed Hiring Lab.

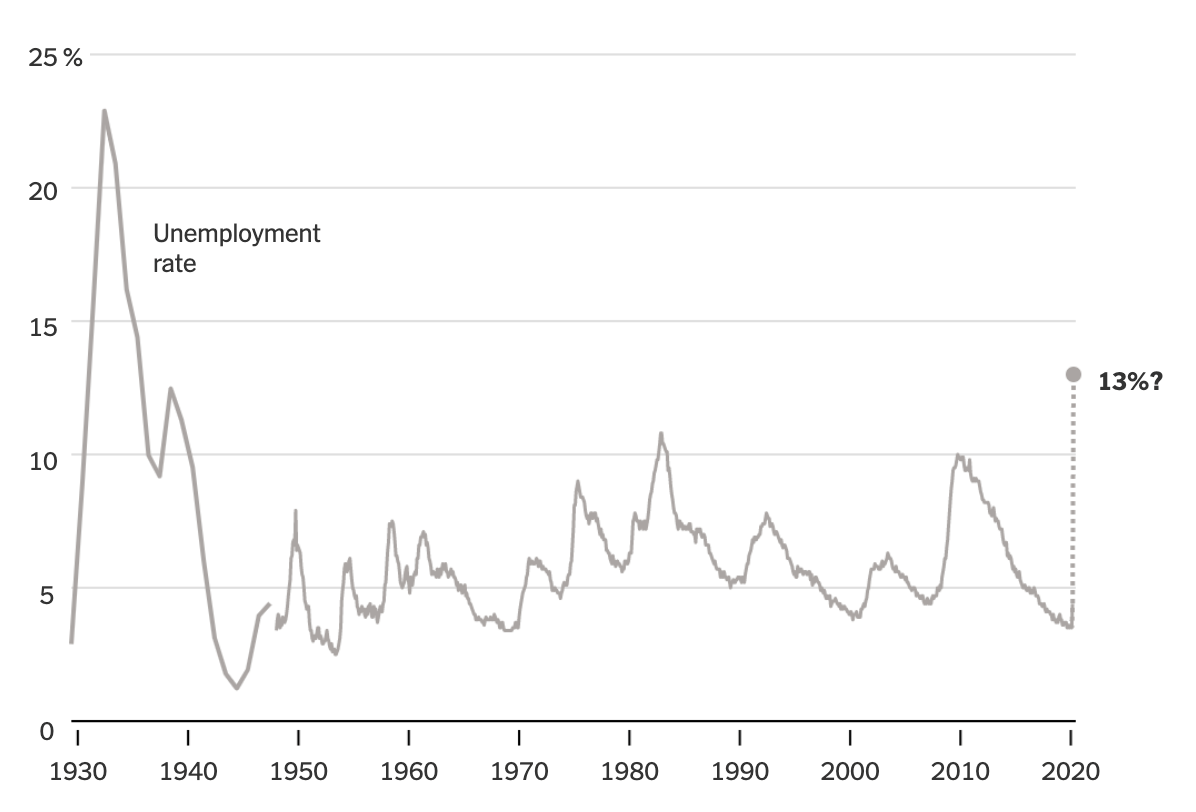

“The jobless rate today is almost certainly higher than at any point since the Great Depression. We think it’s around 13 percent and rising at a speed unmatched in American history.”

— Justin Wolfers, professor of economics and public policy at the University of Michigan.

“The worst is yet to come . . . I assume consumer confidence is going to collapse.”

— Danny Blanchflower, professor of economics at Dartmouth College.

“The psychology won’t just bounce back. People have had a real shock. The recovery will be slow, and certain behavior patterns are going to change, if not forever at least for a long while.”

— Charles Dumas, chief economist at TS Lombard, an investment research firm in London.

“Global growth will be below trend in early 2021, but the strongest global recovery in a decade will play out by the end of 2021 if the vaccine prospects play out as expected.”

— Joyce Chang, chair of global research at JP Morgan.

All in all, the forecast is looking pretty grim.

The coronavirus has brought uncertainty. No one knows how long the coronavirus will last or how long the response measures will stay in place.

So consumers are reigning in their spending and playing it safe.

How to Prepare for an Economic Recession in 2021

Although the situation looks bad, there are things you can do to minimize the impact on life for you and your family.

Here are six tactics to help you weather the storm.

1. Live Within Your Means

To maintain healthy finances, it’s essential to live within your means.

If you spend more than you earn, the debt you incur could land you in hot water during a recession. The main exception to this rule is if you plan to purchase something large, such as a house.

As Thomas Jefferson, the third President of the United States, said, “Never spend your money before you have earned it.”

It’s a good idea to create a monthly budget and track your spending.

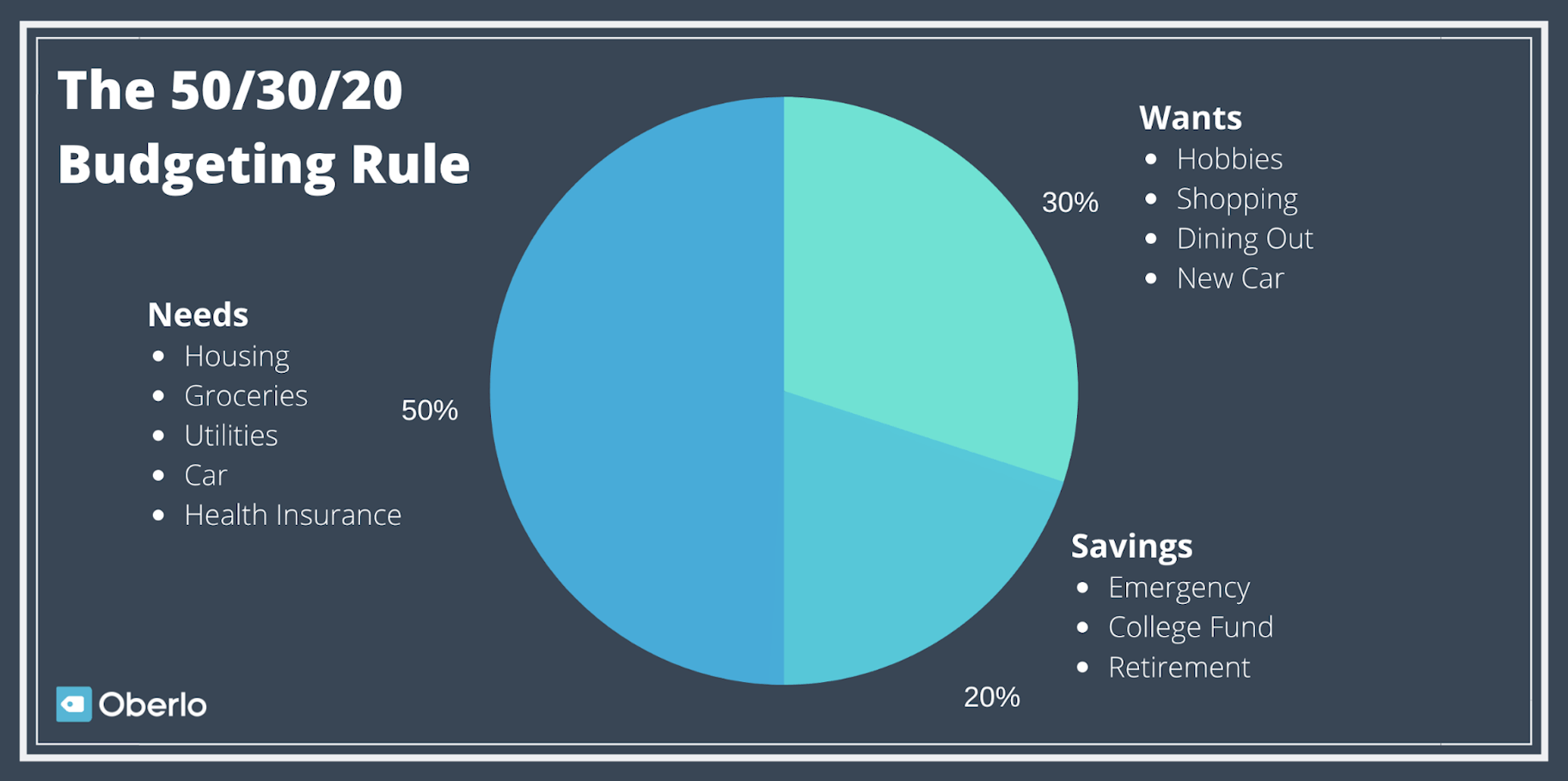

If you haven’t created a budget before, consider following U.S. Senator Elizabeth Warren’s 50/30/20 rule.

This general rule of thumb suggests that you spend your income in the following way:

- 50% on needs, such as housing, groceries, utilities, and health insurance.

- 30% on wants, such as shopping, dining out, and hobbies.

- 20% on savings, such as emergency savings, a college fund, or retirement plans.

2. Identify Ways to Cut Back on Spending

Now that you’re managing your money, go through your budget regularly and look for ways to reduce your outgoings.

The aim of the game is to cut non-essential purchases to free up more money.

For example, you might find that you spend more on takeout or clothes than you originally thought. These types of purchases might seem small, but they quickly add up.

3. Grow Your Emergency Savings

During a recession, it’s even more important to create a financial cushion to remain safe if disaster strikes.

The best way to increase your emergency savings is to funnel money away from non-essential purchases such as new clothes, tech devices, or cars.

As Margo Vader, a financial author, said, “Small amounts saved daily add up to huge investments in the end.”

On the bright side, the coronavirus has made saving easier.

Many borders are closed, people are self-isolating at home, and businesses have closed down or reduced their open hours. As a result, you may have less opportunity to spend money on vacations, dining out, socializing, or shopping.

Try to avoid using this money for other purchases and save it instead.

4. Sell Your Unwanted Stuff

This can buy you a few months of financial relief.

To start, go through your house and see what products you no longer need. Spare rooms and basements are a treasure trove, from obsolete gaming consoles to broken kitchen equipment.

You can convert these things into liquid cash by visiting the local market or selling them on eBay.

5. Pay Down Your Debts

It’s crucial to pay down debts as much as possible – and as quickly as possible.

It’s best to prioritize high-interest debts, such as credit cards. Then turn your attention to other types of debt, such as mortgages or car loans. This way, you pay less interest overall.

If the worst comes and you experience a job loss or have to take a pay cut, you’ll be in a better position.

It’s worth noting that even if you feel secure in your job or business, paying off debt is good financial practice.

6. Take Advantage of Relief Programs

In many countries, the state and federal governments will take action during a downturn to help those in need.

For instance, the US government has moved the tax filing deadline from April 15th to July 15th. Plus, it’s announced an automatic extension for taxpayers to pay their tax bills without any interest or penalty.

Additionally, a temporary moratorium on evictions and foreclosures of homeowners with federally backed mortgages has been established under the CARES (Coronavirus Aid, Relief, and Economic Security) Act.

If you’re currently experiencing financial hardship due to the pandemic, and your mortgage is federally backed, you might also be eligible to receive forbearance on mortgage dues.

Keep an eye out for such relief programs. You can also check with the community organizations and activist groups in your area to see if they can offer some kind of support to help you stay afloat through the recession.

7. Do Not Panic Sell

Nose-diving stocks can be unnerving and cause you to move your money out of the stock market.

However, panic selling can result in long-term losses if the markets go back up.

For example, many investors unloaded their holdings when the 2008 recession caused the market to plummet. But the market bottomed in Q1 of 2009 and then rose to its former levels and defied expectations later. People who remained in the market eventually recovered and realized the biggest gains.

The key takeaway? Hold onto those investments and wait for the markets to recover.

8. Improve Your Education and Skills

If you lose your job, take a pay cut, or your business suffers, you’ll need to find a way to increase your income.

So it’s best to start preparing now.

Even if you can’t afford to pay down your debt or increase your savings, try to improve your skills and education.

Plus, there are plenty of free online courses available. (Oh, this is where we plug our own courses, some of which are free for a limited time!)

Khan Academy is a non-profit whose mission is “to provide a free, world-class education for anyone, anywhere.” Online course provider Coursera has 1,524 courses that are tagged as “free.”

There are also tons of free resources online for entrepreneurs, such as the Shopify Academy.

9. Supplement Your Income

Ultimately, the best way to withstand an economic recession and the coronavirus economy is to make more money.

For this reason, find ways to help your business grow, consider building a passive income stream, taking another job, or working more hours at your current job.

Here are six potential side hustle ideas you could start today:

- Start a dropshipping business

- Begin freelance writing

- Become an affiliate marketer

- Be part of the gig economy on sites like Upwork or Fiverr

- Start and monetize a blog

- Become an Instagram influencer

Now, with the economic changes taking place, which industries are likely to remain secure?

Which Industries Benefit from an Economic Recession?

Unfortunately, most industries suffer to varying degrees during an economic recession.

Vítor Constâncio, former vice-president of the European Central Bank, said that the economic recession “is coming from a demand deficiency and the disturbance on the supply chains.”

In other words, consumers are spending less because many are self-isolating at home. Plus, manufacturers and shipping companies are affected by sick workers and government restrictions.

However, it’s not all bad news. Some industries benefit from economic recessions.

So whether you’re an entrepreneur, investor, digital nomad, or employee, it’s a good idea to keep these particular industries in mind. That way, you can identify opportunities to increase your income during the downturn.

Here are ten industries that are likely to benefit or remain largely unaffected during an economic recession.

1. Grocery Stores

Whether an economic recession happens or not, people still need to eat!

During hard times, many people dine out less to save money. Instead, they opt to buy ingredients and cook at home themselves.

This means that supermarkets, convenience stores, and grocery stores are likely to see a boost in sales.

We might also see an increase in kitchenware sales and online traffic to cooking recipe websites.

2. Consumer Staples

Just like the need for food, people are going to continue showering, brushing their teeth, using the toilet, and cleaning their homes.

The demand for these items is likely to stay the same.

3. Bargain and Discount Stores

Many people will cut back on luxury items during an economic recession.

As people look to save a few extra dollars wherever they can, it’s likely that bargain and discount stores will see an increase in sales.

4. Auto Repair and Maintenance

During a tough economic recession, many people will avoid buying a new car and choose to purchase a second-hand car or repair their existing car.

Consequently, used car dealers, auto repair shops, and businesses who sell car parts might experience an increase in sales.

But that’s not all.

People who usually put their cars in the shop might decide to fix them at home. So there could be an increase in auto repair tool sales and web traffic to car maintenance websites.

5. Do-It-Yourself Suppliers

Similarly, many people will forgo the cost of hiring a building contractor and take on home improvement projects themselves.

So businesses who provide tools and do-it-yourself supplies are likely to see an increase in sales.

Again, websites teaching do-it-yourself skills might also see an increase in traffic.

6. Rental Agencies and Property Management Businesses

During an economic recession, many people may not be able to afford to buy a home. And unfortunately, some people will need to sell their homes if they need money or can no longer afford the mortgage.

These people will need to find rental accommodation.

For this reason, landlords, rental agents, and property management companies often thrive during an economic recession.

7. Accountants and Financial Advisors

Even if there’s an economic recession in 2021, businesses and individuals still need to file their taxes.

What’s more, with drastic changes to the economy, many people will need financial guidance. This means that financial service providers such as accountants and financial advisors may remain unaffected.

8. Pet Food and Supplies

With more people working from home, pets are getting all the attention they crave from their owners.

This increase in attention has led to a surge in the demand for pet food and supplies, as pet owners look to ensure they’re taking good care of their little companions while at home.

So pet products stores might see an increase in web traffic and customers in 2021.

9. Healthcare Providers

During any economic recession, everyone still needs to maintain their health.

However, as this recession is caused by the coronavirus, it’s guaranteed that healthcare providers will see an increase in demand.

10. Funeral Services

People still pass away during a recession, and unfortunately, many people will succumb to the coronavirus.

As a result, death and funeral service providers are likely to see an increase in demand during the economic recession in 2021.

Summary: Economic Recession 2021

Economic recessions are tough.

Remember, an economic recession is a period in which a country’s gross domestic product (GDP) stops growing and starts shrinking.

During an economic recession, nearly everyone suffers in some way.

Businesses and individuals go bankrupt, the unemployment rate rises, wages go down, and many people have to reign in their spending.

Unfortunately, a global economic recession in 2021 seems highly likely.

The coronavirus has already delivered a major blow to businesses and economies around the world – and top experts expect the damage to continue.

Thankfully, there are ways you can prepare for an economic recession:

- Live within you means

- Identify ways to cut back on spending

- Grow your emergency savings

- Sell your unwanted stuff

- Pay down your debts

- Take advantage of relief programs

- Do not panic sell

- Improve your education and skills

- Supplement your income

Although many industries will suffer terribly, there are opportunities to start a business, invest, or gain employment in industries that could remain unaffected by the economic recession in 2021. These industries include:

- Grocery stores

- Consumer staples

- Bargain and discount stores

- Used cars, auto repair, and maintenance

- Do-it-yourself suppliers

- Rental agencies and property management businesses

- Accountants and financial planners

- Pet food and supplies

- Healthcare providers

- Funeral Services

What’s your take on the global economic recession in 2021? Let us know your thoughts in the comment section below.